Message from Chairman and

Group CEO

• Over the past 2 years, the Pruksa Group has implemented the “Live well Stay well” strategy to create residential living experiences that are integrated with healthcare businesses, aiming to provide residents with a quality of life that is to live well and stay well (Please see “What Does the Tree of Happiness Look Like?” at https://www.youtube.com/watch?v=YXFlDwdHJFc). Additionally, the Group has established its vision, mission, and organizational culture, as well as new businesses that support a business ecosystem around its core businesses and that build a foundation for sustainable business. Another challenge this past year was to generate operational growth amid weak global economic conditions caused by various factors that had both direct and indirect impacts on the overall Thai economy and real estate industry.

- Inflationary pressures, in particular, led to increased raw material costs and transportation expenses, resulting in subsequent interest rate hikes. This has impacted homebuying demand due to credit restrictions on home loans in accordance with measures by the Bank of Thailand.

- However, the overall situation began to improve towards the end of the year. Oil prices have begun to normalize, interest rates are showing signs of stability, and government measures to reduce property transfer fees and mortgage fees have further stimulated the real estate sector.

- In 2024, tailwinds in Thailand’s economy are expected to contribute to further growth over the previous year. This includes an anticipated increase in foreign tourist arrivals stimulating the domestic economy, as well as greater foreign investment following trends of risk diversification and the relocation of manufacturing bases to Southeast Asian nations. Government projects are also expected to further stimulate the economy, particularly in promoting the health & wellness industry in Thailand. This is also expected to generate interest in the Group’s healthcare business.

- In 2024, global risks persist due to various geopolitical conflicts, high interest rates in major economies, and the continued upward trend of inflation rates in Thailand. Public debt and household debt in the country continue to increase accordingly.

- To strengthen and prepare the Pruksa Group:

1) Over the past year, the Group implemented a strategic approach by adopting the concept of profit centers with the potential to bear fruit immediately while supporting the long-term growth of the entire Group. This includes spinning off the precast concrete business into a new company called Inno Precast and drawing interest from General Engineering Public Company Limited to join as a business partner, combining precast production and enhancing production capacity for Precast Facade, or precast concrete components for exterior walls used in condominium projects. This has expanded the customer base to over 30 clients, with a backlog of orders worth over THB3 billion, demonstrating the mutual capabilities of the businesses and significantly accelerating growth at Inno Precast. It also reflects the true value of Inno Precast, with plans to list the company on the stock market in the future. Additionally, the medical laboratory operations of Lab Plus One Co., Ltd. were transferred under a joint venture with Pathology Asia Holdings Pte. Ltd. The two transactions resulted in the Pruksa Group earning extraordinary profits of more than THB692 million in 2023.

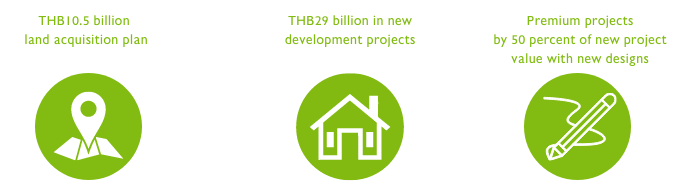

2) Although the real estate market in 2024 still faces various uncertainties that may prevent overall market growth as expected, the Group’s real estate business has prepared plans accordingly by introducing townhouses under the “Baan GreenHaus” brand at affordable prices, with installments starting from just THB3,000 per month. There are also plans to introduce “The Palm” Pattanakarn and Watcharapol projects, which integrate new passive home designs suitable for all ages. Furthermore, there are preparations in place to launch mid- to high-end residential projects to meet the current diversity of residential demands and increasing interest from returning foreigners with high purchasing power.

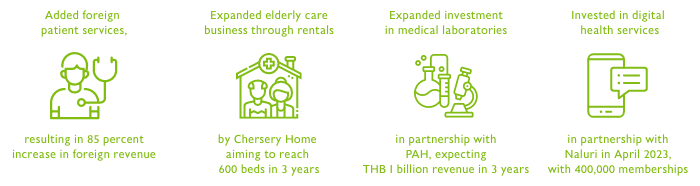

3) In 2023, ViMUT Hospital expanded capacity from 100 to 150 patient beds to accommodate growth in 2024, while expanding the range of medical treatments offered. They targeted patient groups such as corporate clients, insurance firms, and international customers. ViMUT also emphasized collaboration with public hospitals and both local and international partners. These collaborations served as a vital component in driving revenue growth for the healthcare business, achieving over 50 percent growth to reach revenues of THB1.82 billion in 2023. The Hospital Group’s assets will be geared towards generating immediate revenue and profits in 2024, as Thailand positions itself as a medical hub of Southeast Asia.

4) The Group’s asset allocation includes ventures in the logistics industry through the establishment of the CapitaLand SEA Logistics Fund and investments in wellness and healthcare-related real estate under the CapitaLand Wellness Fund. These initiatives not only supported core businesses but also generated recurring income through collaborations with global partners. Furthermore, the Group established a new business under Synergy Growth. In 2023, the MyHaus application and the Clickzy.com e-commerce platform were launched to provide conveniences for homeowners and support the Company’s “Live well Stay well” strategy. Additionally, the Company expanded its services, developed internally by the organizational team, to provide interior design and furniture distribution services. The Company has subsequently spun off and established ZDecor, which is to be launched in 2024 for strategic investments and to further market penetration in Southeast Asia.

- Amidst these conditions of the global real estate industry, which has signs of crisis due to increasing bond default rates and with many companies in Thailand facing similar issues, Pruksa Holding Group has continued to maintain robust financial stability despite greater investment diversification in various businesses in recent years, with a low net interest bearing debt-to-equity ratio of only 0.27x.

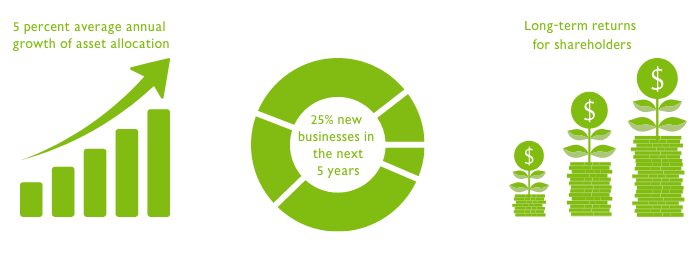

- Furthermore, the Company continues to prioritize asset quality management by disposing of non-income-generating assets, accelerating development and sales, and integrating technology into new designs to enhance product appeal. Additionally, investment diversification of income-generating assets has increased from 17 percent to 31 percent by the end of 2023, with new investments complementing core businesses. This improves long-term profitability and enables the adoption of innovations and technologies from external sources to enhance operations and business growth. We are confident that these benefits will be passed on to shareholders in the long term.

- The March 2023 announcement of the Group’s corporate purpose demonstrated its commitment to delivering quality living experiences through its “Live well Stay well” strategy. This involves innovating new sustainable housing designs, such as low-carbon homes, resulting in the reduction of 329 KgCO2e (kilograms of carbon dioxide equivalent) per home, alongside promoting good health and community well-being. Both products and services are delivered through its two main businesses: real estate and healthcare. Over the past year, the Group has reduced carbon emissions by over 10,190 tCO2e (tons of carbon dioxide equivalent), while establishing companies for research related to natural resources and the environment for the benefit of society as a whole and in connection with Group’s future businesses. Furthermore, the Group has supported employees, homeowners, government agencies, and neighboring communities in planting over 74,000 trees across 370 rai and promoting the care of over 1,000 rai of community forests in the northern and northeastern regions of Thailand, embodying the organization’s culture of “Impact for Good” and fostering positive relationships with homeowners and communities.

- We not only aim to develop sustainability within the organization but also believe that supporting businesses that create positive social and environmental impacts will drive society in a more positive direction. This is the essence of the “Accelerate Impact with PRUKSA” project, Season 1 of which had been successful in reducing income inequality and providing proactive solutions for elderly care. In Season 2, our focus remains on promoting physical and mental well-being, reducing income disparities, fostering essential job skills, and creating positive environmental impacts.

You may see the Group’s Social Enterprise Programs here:

Pruksa Everyone Matters I Ep.2 Buddy Homecare - Life Balance

Link: https://www.youtube.com/watch?v=MOrkZBWbkbk

Pruksa Everyone Matters I Ep.3 Local ALike - Grow Home

Link: https://www.youtube.com/watch?v=OVdYgOOq_xQ

Pruksa Everyone Matters I Ep.4 findTEMP - The Opportunity 100 บาทของเราไม่เท่ากัน

Link: https://www.youtube.com/watch?v=kv5Je8tCTVw

- In 2023, the world faced sudden and increasingly severe changes in various aspects. These changes were evident in the volatile weather conditions and extreme natural disasters, as well as in the rapid shifts in technology and competition that even overwhelmed corporate giants. This has spurred the concept of sustainable business, aiming for not just short-term growth but long-term sustainability. This has become a focal point that has generated positive impacts through the development of innovation and technology.

- The sustainable development of the Group has been achieved by upgrading work processes and profit generation to contribute to society and the environment via collaborations with various expert partners. This has been achieved through a business model that reduces asset holding while restructuring the construction and precast businesses and expanding the customer base. These initiatives foster diverse knowledge exchange and increase recurring income. The transfer of Lab Plus One operations to the ViMUT Hospital Group further enhances collaboration with expert partners in Southeast Asia. Investment in the logistics industry as well as wellness and healthcare-related real estate marks a revolutionary change in the Group’s business operations, driving business through an “Outside-In Innovation” strategy to prioritize responding to consumer lifestyles and needs. Policies such as managing work in “Centers of Excellence” and using “Robotic Process Automation (RPA)” reduce operational costs, minimize errors across various job types, save personnel costs, and support employees to work more analytically. These initiatives collectively push all employees in the organization to continuously adapt and see the bigger picture for sustainable long-term growth.