Corporate Info

CORPORATE

Registered Capital and Paid-Up Capital

As of December 31, 2024

- Registered capital amounted to THB2,188,504,922 consisting of 2,188,504,922 ordinary shares with a par value of THB 1.

- Paid-up capital amounted to THB2,188,504,922 consisting of 2,188,504,922 ordinary shares with a par value of THB 1.

Stocks totaling

Shares

Core business is more than

85%

of total assets of the Company

The Company earns its main income from dividends of shares from the following core businesses: 1) property development for sale and 2) healthcare. The Company maintains no less than 85 percent of the total assets of its core business operations, with Pruksa Real Estate Public Company Limited as a subsidiary that operates the property for sale business, ViMUT Hospital Holding Company Limited as a subsidiary that operates the healthcare business, and subsidiaries and/or associated companies that the Company has invested in.

The Company has a policy of investment diversification, seeking other business opportunities aside from the real estate business

for the Company to achieve sustainable growth in its performance and recurring income from business operations. That is why it has invested in its healthcare business to operate a private hospital, which opened to the public on May 1, 2021. Moreover, the Company has also expanded its healthcare services to other modes to support “Better homes and Healthier communities.”

Objectives of Establishing a Holding Company

For flexibility in business expansion and open up the opportunity to find joint ventures with expertise in that particular business, which is considered to increase the opportunity for new business operations according to the Company's long-term strategic plan

Limit the scope and manage business risks

Increase the efficiency and flexibility of the organization's management structure to suit future business operations

Enhance competitiveness and seek for opportunity to increase shareholder returns

Milestones

Year:

2024

2023

2022

2021

2019

2018

2017

2016

2015

2013

2005

1993

January

- Pruksa Real Estate launched the premium single- detached house project, “The Palm Bangna-Wongwaen 2,” with prices starting at THB15.99 million. The project comprises 84 units, with a total value of THB1.9 billion. It prioritizes passive and universal design to accommodate Thailand’s climate and cater to residents of all ages.

- ViMUT Hospital announced a partnership with Amili, a leading tech company in Singapore specializing in gut microbiome technology. Together, they launched the Gut Microbiome Test, designed to assess the balance of microbiomes in individual patients as part of a preventative healthcare approach.

- Pruksa Real Estate signed a joint venture agreement with a subsidiary of Origin Property Public Company Limited to invest in three projects, with a total value exceeding THB8.7 billion. The projects include a mixed-use development, a premium condominium project, and a premium single-detached house project.

February

- Synergy Growth Co., Ltd. launched MyHaus, an innovative application designed to provide comfort and convenience for Pruksa residents. The application integrates IoT systems and security features to create a seamless smart home experience.

March

- The Company supported social enterprises through “Accelerate Impact with PRUKSA Season 2.” As part of this initiative, the Company selected Agnos Health Co., Ltd., an expert in medical AI development, to collaborate with the Medical Service Department. An AI system for patient screening is implemented through the Line official accounts of public hospitals. This system aims to reduce congestion in hospitals, alleviate the burden on healthcare professionals, and minimize unnecessary medical expenses.

- Theptarin Hospital rebranded as ViMUT-Theptarin Hospital. As part of the rebranding, the hospital renovated its facilities and upgraded its endocrine treatment and medical services to meet international standards. This strategic initiative supported and strengthened PSH’s overall business ecosystem.

April

- Two subsidiaries were established: Vimut Property Thonglor Co., Ltd. and Thai Orthopedics Co., Ltd. These subsidiaries are dedicated to operating orthopedic hospitals in collaboration with expert medical professionals. This initiative supports ViMUT Group’s goal of becoming the Trusted Healthcare Platform.

May

- ViMUT Holding partnered with Namwiwat Medical Corporation PCL to establish a subsidiary, SERVISO Healthcare Solutions. This subsidiary specializes in providing comprehensive cleaning and disinfection services for medical instruments, alongside the management and treatment of medical hazardous waste. This initiative aims to expand the hospital group’s market reach, offering additional services and generating more recurring income.

- Pruksa Real Estate launched “The Palm Residences Watcharapol,” a super-luxury single-detached house project in the form of pool villas. In collaboration with PSH’s subsidiaries, Pruksa Real Estate aims to deliver residences that emphasize innovation and comprehensive health services for all age groups. Priced between THB30 to 40 million, the project comprises only 40 units, with a total value of THB1.39 billion.

June

- Pruksa Real Estate, in collaboration with the ViMUT Hospital Group, launched “PINE Wellness Residence Prachachuen,” the first full-scale wellness home model. This project offers comprehensive health services, personal assistant services, and amenities to enhance the quality of life for residents of all ages.

- Synergy Growth Co., Ltd. partnered with Wizlah Ventures from Singapore to invest in Zdecor, a startup specializing in home decoration design and furniture sales under PSH. The company was then rebranded as Wizlah TH to develop the Wizlah Super App, a comprehensive home decoration platform operating in Thailand.

- Pruksa Real Estate has partnered with Siam City Cement PCL since 2019 to incorporate hydraulic cement, also known as “green cement,” into its concrete mixtures for Pruksa’s residential projects. This collaboration has contributed to a reduction of nearly 5 million tons of greenhouse gas emissions.

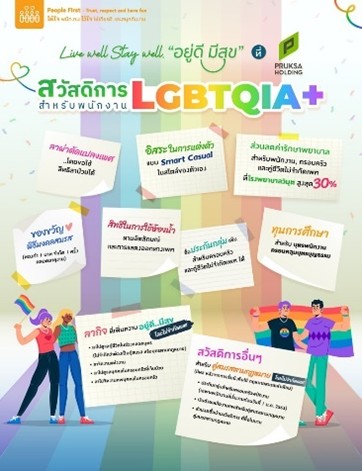

- PSH promotes diversity and inclusion within the organization and complies with the Marriage Equality Act by offering benefits to the LGBTQIA+ community. These benefits include wedding gifts for all genders, sick leave for gender-affirming surgeries, and the freedom to dress according to one’s gender identity.

July

- ViMUT Holding established a new subsidiary, Thonglor Well Holding Co., Ltd., to hold shares in company that owns assets related to orthopedic hospital. This strategic move aims to support the expansion of specialized orthopedic hospital businesses.

- Pruksa Holding promotes the use of clean energy through Green Leaf Energy by installing solar roof systems in residential projects such as The Palm Residences Watcharapol. The Company also plans to expand these installations to other projects, including hospitals under the ViMUT group.

August

- ViMUT Holding partnered with Namwiwat Medical Corporation Public Company Limited to introduce the iNAP Sleep Therapy System, an innovative solution for treating snoring and obstructive sleep apnea across all severity levels.

September

- Pruksa Holding has been assigned a company rating of “BBB+” with a “stable” outlook by TRIS Rating.

- ViMUT Hospital inaugurated its Maxillofacial Contouring Center to cater to the increasing demand for aesthetic health services among the younger generation. This initiative aligns with the hospital’s goal to become a leader in comprehensive healthcare services that encompass both health and beauty.

October

- Pruksa Holding organized the “ESG DAY 2024: Everyone Matters“ event to promote a corporate culture. The event aimed to raise awareness among all employees about the importance of human rights, anti-corruption measures, and understanding their roles and responsibilities within society.

- ViMUT Hospital launched its Urology Center, introducing the innovative “UROLIFT” technology for the treatment of benign prostatic hyperplasia (BPH). This minimally invasive endoscopic procedure offers a high safety profile, reduced risk of complications, and a shorter recovery period, while raising the standards of medical services in Thailand.

November

- Pruksa Real Estate has introduced a super ultra-luxury single-detached house project, “The Palm Residences Pattanakarn”, featuring pool villas. This development is in collaboration with other companies under Pruksa Holding, aiming to provide innovative residences and comprehensive health services for all age groups. The project comprises only 57 units, each priced between THB45 to 80 million, with a total project value of THB2.74 billion.

December

- ViMUT Hospital Phaholyothin has achieved Joint Commission International (JCI) accreditation, earning the Gold Seal of Approval®. This recognition underscores the hospital’s success and excellence in patient care.

- Pruksa Holding has refined its business direction and strategies to strengthen its core businesses: real estate, construction and precast, and healthcare. Mr. Thongma Vijitpongpun was appointed as the Acting Group CEO.

January

- Established Omega Logistics Co., Ltd. to advance the real estate and smart logistics businesses across Southeast Asia, following the establishment of the CapitaLand SEA Logistics Fund by the Company in collaboration with Ally Logistic Property and CapitaLand Investment at the end of 2022.

- Restructured the precast business by partnering with General Engineering Public Company Limited (“GEL”) through a 51-percent share swap in Inno Precast Company Limited (“Inno Precast”). This acquisition enabled the Company to hold an 18.26-percent stake in GEL, allowing the precast business to benefit from specialized expertise and reduce costs, expanding its customer base and generating recurring income.

- Launched a collaboration between Ramathibodi Hospital and ViMUT Hospital aimed at generating additional revenue and alleviating overcrowding issues at public hospitals. The initiative enables Ramathibodi Hospital’s patients to utilize the medical equipment and operating rooms of ViMUT Hospital, serving as a model for future collaborations with other public hospitals

March

- The Pruksa Group announced a new corporate purpose to deliver enriching lifestyles according to its “Live well Stay well” strategy. The strategy aims to develop residential projects with innovative designs, combining elements of good health and community well-being to enhance the quality of residential living.

- Signed a ready-mix concrete purchase agreement with Nakhon Luang Concrete Co. Ltd. in preparation to produce low-carbon precast concrete slabs for quality, eco-friendly residences.

April

- ViMUT acquired additional ordinary shares, increasing its stake by 80 percent in NLR TH Co., Ltd., which holds a 51-percent stake in Naluri Therapeutics Co., Ltd., which is engaged in digital health services for both business-to-business (B2B) and business-to- consumer (B2C) customers in Thailand.

- Celebrating its 30th anniversary, Pruksa Real Estate has evolved from a townhouse developer to providing various types of residences, including townhouses, single-detached houses, and condominiums, along with investments in healthcare businesses to deliver residences that promote “Live well, Stay well” to homeowners.

- Established three subsidiary companies - ReGen Innovation Co., Ltd., ReGen Management Services Co., Ltd., and ReGen Property Co., Ltd. - to engage in innovation research, consulting, and product development/production related to natural resources and the environment, furthering its environmental priorities.

May

- Closed deal between Inno Precast and GEL to establish itself as the leading low-carbon precast concrete slab manufacturer in Thailand, with purchase orders exceeding THB1.2 billion. Additionally, Inno Precast secured green loan totaling THB2.07 billion from TMBThanachart Bank Public Company Limited to enhance its capacities and support business growth.

- Supported Thai companies through the “Accelerate Impact with PRUKSA” project, providing financial and knowledge support to businesses or organizations making a positive impact on society, the environment, and building sustainable communities.

- Celebrating its 2nd anniversary, ViMUT Hospital announced its commitment to become a fully comprehensive trusted healthcare platform, offering integrated healthcare services and accelerating the expansion of medical services to encompass all aspects of an aging society.

June

- Ranked in the ESG100 by the Thaipat Institute, reflecting the organization’s commitment to driving the business forward with ESG principles as a fundamental priority.

August

- Received TRIS rating of A- for organizational credit and guaranteed bonds, with a “stable” outlook.

- ViMUT Hospital opened an Endoscopy & GI Motility Unit to effectively enhance the care and treatment of patients with complex and challenging conditions.

- Established Inno Home Construction Co., Ltd.(“Inno Home”) as a separate business unit of the Company to manage operations flexibly and introduce services for new customers and markets.

September

- Transferred the business operations of Lab Plus One Co., Ltd., an indirect subsidiary of the Company, to Innoquest Diagnostics One (Thailand) Co., Ltd., a joint venture between ViMUT and PAH (Thailand) Pte. Ltd. This transfer is expected to benefit the medical laboratory business by leveraging the expertise of Pathology Asia Holdings, one of the largest medical laboratory service providers in Southeast Asia.

October

- Collaborated with CapitaLand to establish the CapitaLand Wellness Fund (“C-WELL”) to invest in health promotion and housing in Southeast Asia, leveraging the expertise of both the real estate and healthcare businesses of the Group, as well as the fund management and hospitality management of CapitaLand and The Ascott.

- Acquired a 4.86-percent stake in Nam Viwat Medical Corporation Public Company Limited (“NAM”) as part of another collaboration to further develop the disinfection segment of the medical equipment business.

November

- Selected as a sustainable stock with a SET ESG Rating of BBB by the Stock Exchange of Thailand, reflecting the organization’s commitment to ESG principles as a fundamental priority.

- ViMUT Pharmacy Solutions Co., Ltd. and Amili Pte. Ltd. (“Amili”) partnered to establish Amili Health (Thailand) Co., Ltd., and hold 51 percent and 49 percent of shares, respectively, expanding the business for gut microbiome-related products and research. Amili possesses the largest database and sample repository of microbiomes in the world and the only one in Southeast Asia.

- The Company and ceEntek Pte. Ltd. partnered to establish ceEntek (Thailand) Co., Ltd. and hold 51 percent and 49 percent of shares, respectively, producing low-carbon ultra-high performance concrete for general construction.

December

- Acquired a 25-percent stake and a convertible loan worth THB150 million in K.P.N. Senior Hospital Group to expand the elder care hospital business for long-term recovery and physical therapy, supporting Thailand’s journey toward becoming a global Senior Destination.

- Inno Precast increased capital to invest in and lease assets in GEL’s precast concrete business. The Company, both directly and indirectly, has a combined shareholding of 54.9 percent of the total registered capital in the precast business.

- Promoted value engineering by incorporating hollow core, new design ground beam & cement jointing into construction process

- Adopted Blockchain technology to 100% construction material vendors

- Opened first ViMUT wellness at Bangna-Wongwaen

- Set up Bt3.5 bn corporate venture fund to invest in Proptech, HealthTech & SustainabilityTech to support “outside-in” innovation to grow its core businesses

- Invested in e-Commerce business including Pundai and MyHaus Tech

- JV with Gunkul Engineering PCL to provide solar roof installation for Pruksa residences

- JV with Pathology Asia to expand to genomic & laboratory services in Thailand

- First to launch low carbon precast in Thailand, spun off precast concrete business and established Inno Precast as a profit center business

- Jointly established CapitaLand SEA Logistics Fund to develop smart logistics infrastructure

- First commenced operation of Vimut Hospital in May

- Adopted Blockchain Solution for Procure-to-Pay to enhance integrated procurement and payment system

- Launched a new business "DEAL", providing services in buying, selling, renting houses by using digital platform

- Pruksa Brand was awarded the national level “Brand of the Year” at the World Branding Awards

- Rebranded the corporate logo with a new slogan called “PRUKSA...Heart to Home”

- Opened “Baan Mor Vimut” to provide general medical service and health service to local residents.

- Launched Pruksa's first super-luxury condo project “The Reserve Sathorn”

- Opened Pruksa's official headquarters “Pearl Bangkok”

- Establishment of Vimut Hospital Holding Co., Ltd. And Vimut Hospital Co., Ltd. to engage in hospital business

- Established holding company under the name of “Pruksa Holding Public Company Limited”

- Initial trading in SET on December 1, 2016 under the ticker “PSH”, changed from “PS”

- Ranked as the number one in real estate business segment in the area of “Innovative creativity” from BrandAge Magazine and Company Magazine

- The golden year of Pruksa Real Estate with highest record-breaking sales volume, total ownership transfers, and number of transferred units

- Developed the Fully Precast System for constructing low-rise condo project and introduced the first Green Precast Factory in Thailand

- Converted into a public limited company on April 27, 2005

- Entered into the first trading in Stock Exchange of Thailand (SET) on December 6, 2005 under the ticker “PS”

- Established Pruksa Real Estate Public Company Limited on April 20, 1993